How Rising Interest Rates Are Affecting Mortgage Loans

Explore the impact of rising interest rates on mortgage loans in 2024, including effects on affordability, refinancing options, and market trends.

As the economy continues to evolve in 2024, rising interest rates are becoming a significant factor in the mortgage landscape. Homebuyers and homeowners looking to refinance are feeling the effects of these changes. This article will delve into how increasing interest rates are influencing mortgage loans, including their impact on home affordability, refinancing decisions, and overall market trends.

1. Impact on Home Affordability

One of the most immediate consequences of rising interest rates is the effect on home affordability:

- Higher Monthly Payments: As interest rates climb, the cost of borrowing increases, resulting in higher monthly mortgage payments for new buyers. This can strain budgets and reduce the overall purchasing power of potential homeowners.

- Reduced Buyer Demand: Higher mortgage payments may lead to a decrease in buyer demand, as some prospective homeowners may decide to delay their purchase or settle for less expensive homes.

- Market Corrections: In response to reduced demand, the housing market may experience corrections, potentially leading to slower price appreciation or even declines in certain areas.

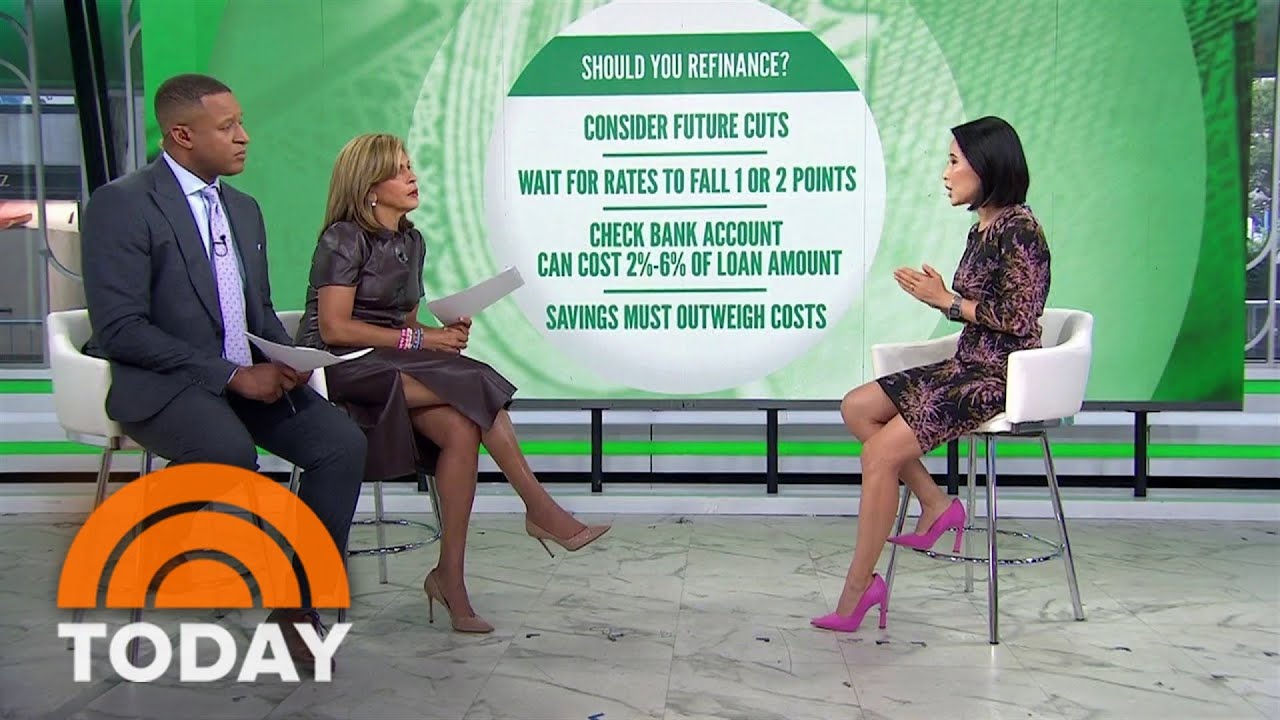

2. Effects on Refinancing

With interest rates on the rise, many homeowners are reconsidering their refinancing options:

- Limited Refinancing Opportunities: As rates increase, the incentive to refinance to a lower rate diminishes. Homeowners with existing low-rate mortgages may choose to stay put, limiting their options.

- Strategic Refinancing: Some homeowners may still consider refinancing to consolidate debt or access home equity, even at higher rates. However, the overall benefits must be carefully weighed against the cost of refinancing.

- Increased Competition for Lenders: As fewer homeowners seek refinancing, lenders may have to adjust their strategies to attract business, potentially leading to more competitive offers for those looking to refinance.

3. Market Trends and Predictions

The impact of rising interest rates is likely to shape the mortgage market in several ways:

- Shift Toward Adjustable-Rate Mortgages (ARMs): With fixed-rate mortgage costs increasing, some buyers may explore ARMs, which typically offer lower initial rates. However, this comes with the risk of future rate adjustments.

- Increased Focus on Affordability Solutions: Lenders may begin to emphasize products that enhance affordability, such as down payment assistance programs or mortgage options tailored to first-time buyers.

- Potential Slowdown in Housing Inventory: As homeowners choose not to sell due to high-interest rates on new mortgages, housing inventory may decrease, leading to a tighter market and potentially higher prices for desirable properties.

4. Conclusion

Rising interest rates are undoubtedly reshaping the mortgage landscape in 2024. For both homebuyers and existing homeowners, understanding these changes is critical for making informed decisions about purchasing, refinancing, and budgeting. As the market adapts, staying informed about trends and available options will empower individuals to navigate the challenges and opportunities that come with higher interest rates.

If you're looking for guidance on navigating the mortgage market during these changing times, contact us today for expert advice tailored to your needs!

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0