5 Essential Steps for Planning Your Retirement Early

Discover five essential steps to help you plan for retirement early, ensuring financial security and peace of mind for your future.

Planning for retirement may seem like a distant concern, but starting early can lead to significant financial security and peace of mind in your later years. By taking proactive steps now, you can ensure a comfortable lifestyle after you retire. In this blog, we’ll explore five essential steps to help you effectively plan for retirement early.

1. Define Your Retirement Goals

The first step in planning for retirement is to clearly define your goals. Consider the following questions:

- What age do you want to retire?

- What kind of lifestyle do you envision in retirement?

- Do you plan to travel, pursue hobbies, or continue working part-time?

Setting specific goals will give you a target to work towards and help you estimate the amount of money you’ll need to save.

2. Assess Your Current Financial Situation

Take stock of your current financial situation to understand where you stand. This includes:

- Evaluating Assets: List your assets, including savings accounts, investments, and any real estate.

- Calculating Liabilities: Identify any debts, such as mortgages, student loans, or credit card debt.

- Reviewing Income Sources: Assess your income from employment, investments, or other sources.

Understanding your current financial situation will help you identify areas for improvement and opportunities for saving.

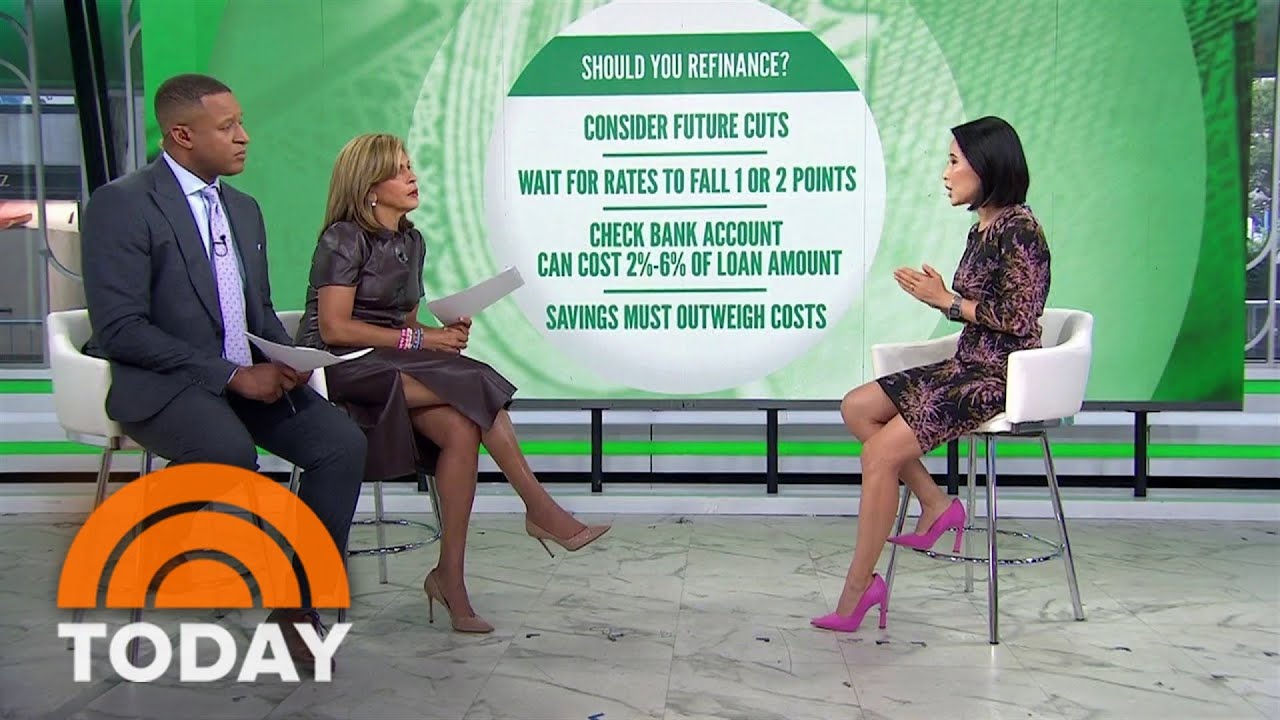

3. Create a Comprehensive Retirement Savings Plan

Developing a robust retirement savings plan is crucial. Here’s how to do it:

- Set a Savings Target: Based on your retirement goals, determine how much money you need to save by retirement age.

- Choose Retirement Accounts: Consider various retirement accounts, such as a 401(k), IRA, or Roth IRA, to maximize your tax benefits and investment growth.

- Automate Contributions: Set up automatic contributions to your retirement accounts to ensure you consistently save over time.

By creating a structured savings plan, you can make steady progress toward your retirement goals.

4. Invest Wisely

Investing your savings is essential for growing your retirement fund. Here are some key investment strategies:

- Diversify Your Portfolio: Spread your investments across various asset classes (stocks, bonds, real estate) to reduce risk and enhance returns.

- Consider Risk Tolerance: Assess your risk tolerance and adjust your investment strategy accordingly. Younger investors may opt for a more aggressive approach, while those nearing retirement might choose conservative investments.

- Stay Informed: Keep yourself updated on market trends and investment opportunities. Regularly review your portfolio and make adjustments as needed.

Investing wisely can significantly boost your retirement savings over time.

5. Monitor and Adjust Your Plan Regularly

Retirement planning is an ongoing process. Regularly review and adjust your plan to ensure you stay on track. Here’s what to do:

- Annual Reviews: Conduct an annual review of your retirement savings and investment performance. This will help you identify areas for improvement and ensure you’re meeting your goals.

- Adjust for Life Changes: Be prepared to adjust your retirement plan based on significant life changes, such as marriage, having children, or career changes. Each of these can impact your financial situation and retirement goals.

- Consult a Financial Advisor: If you’re unsure about your retirement plan or need personalized guidance, consider consulting a financial advisor. They can provide expert advice tailored to your unique circumstances.

Conclusion

Planning for retirement early is a smart financial move that can lead to greater security and a more enjoyable retirement. By defining your goals, assessing your financial situation, creating a savings plan, investing wisely, and monitoring your progress, you can set yourself up for a comfortable and fulfilling retirement.

Ready to start planning for your future today?

Contact Safenture for personalized advice and strategies to help you achieve your retirement goals!

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0